When 1% is not 1%

Michael Hart | August 8, 2025

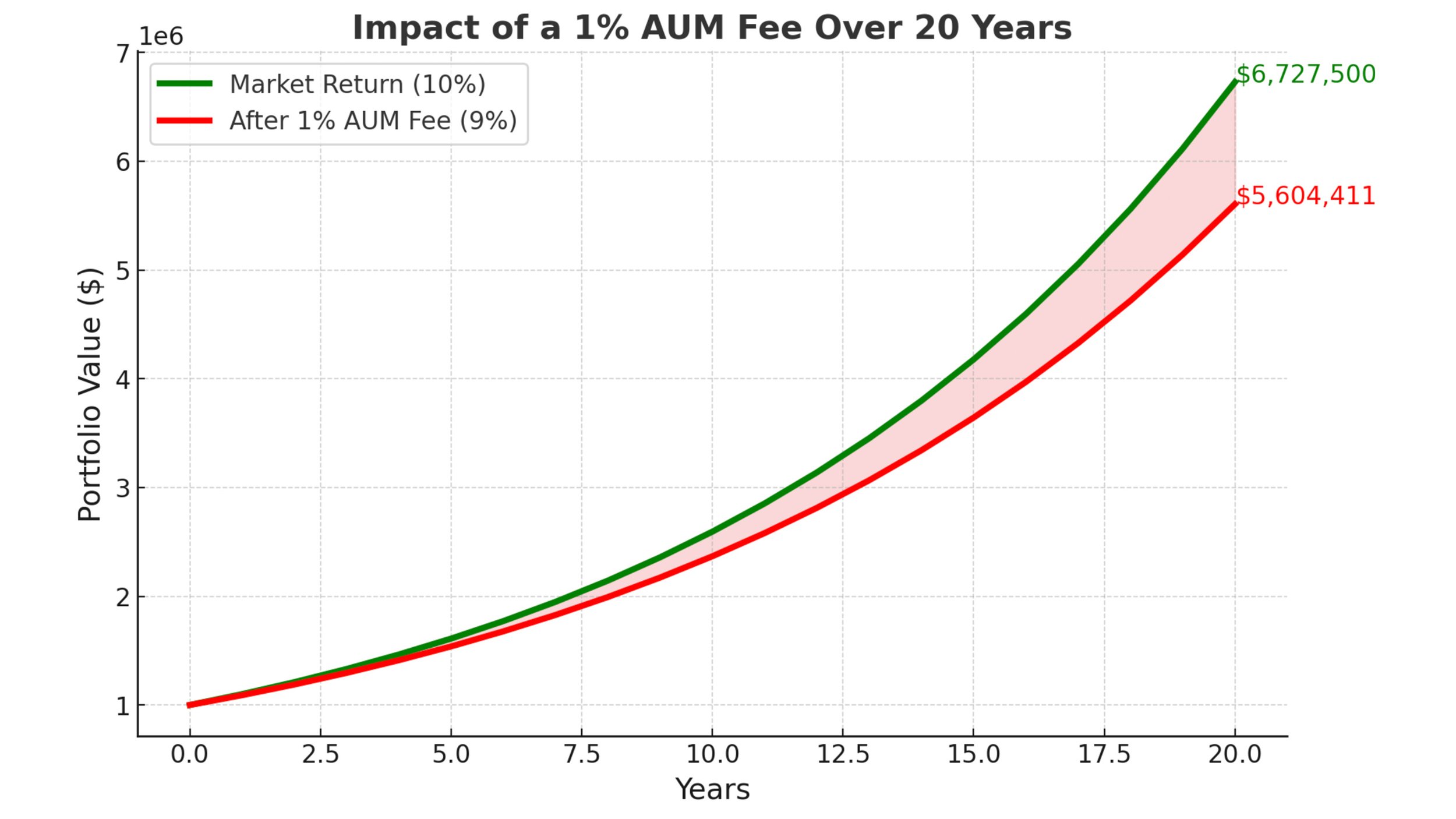

A 1% advisor fee doesn’t sound like much… until you see the math.

Market return: 10%

Advisor fee: 1% of assets under management

Your net return: 9%

That’s not a 1% cost… it’s 10% of your return for the year.

You’re giving up one out of every ten dollars your portfolio earns.

On a $1,000,000 account, that’s $10,000 gone in a single year.

If that $10,000 stayed invested at 10% per year, in 20 years it would be worth $67,000.

And that’s from just one year’s fee.

Pay that 1% every year and the lost growth can add up to hundreds of thousands—even millions over your lifetime.

Every advisor charges fees of some kind—but it’s critical that you absolutely understand what you are paying and how it impacts your returns over time.

Fees don’t just reduce your returns—they reduce the future your returns could have built.