Open enrollment is right around the corner.

Michael Hart | August 23, 2025

Here’s the thing: advisors love to say they do “comprehensive financial planning”... but if they aren’t reviewing your company benefits with you, they’re skipping over roughly a third of your compensation.

It pays to actually look through your options and select the right ones. A few examples:

401(k) match → Don’t leave free money on the table. Also check investment options, allocation, and fees.

HDHP vs PPO → For many high earners, the HDHP comes out ahead at most spending levels, plus it unlocks the HSA (which can be invested).

Disability insurance → If you pay the premium, the benefit isn’t taxable. Huge difference.

ESPP → Especially valuable if there’s a 15% discount with a lookback provision.

Dependent Care FSA → Covers some of your qualified childcare costs.

Life insurance → Take what’s free, but for more coverage it’s usually better (and cheaper) to buy your own policy.

Legal assistance → Sometimes a low-cost way to get wills, trusts, or other legal help.

Gym memberships, student loan help, charitable giving match → Small perks that add up.

If your advisor isn’t walking you through these choices, you’re not getting comprehensive planning—you’re just getting investment management with a new label.

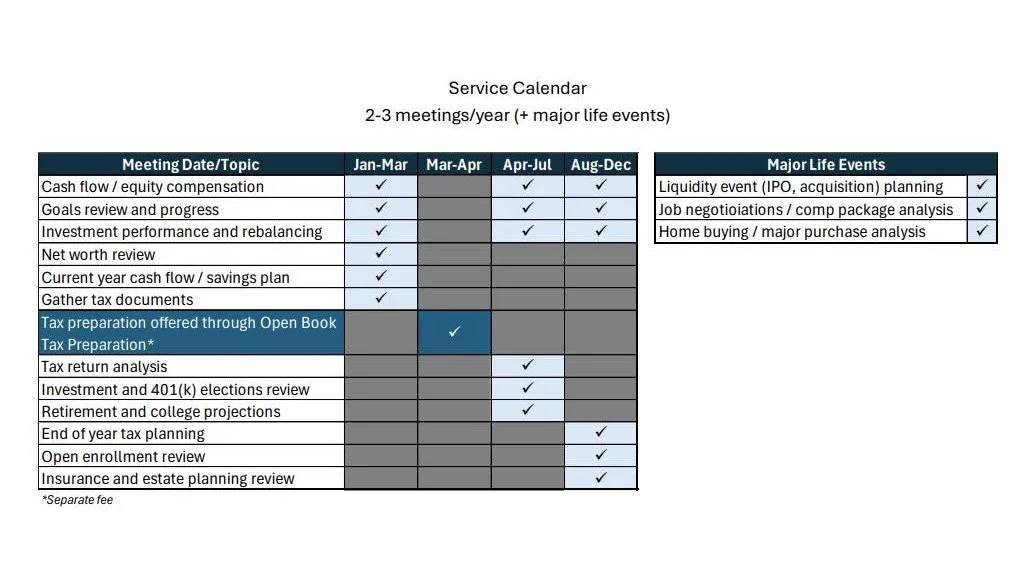

The right open enrollment decisions can be just as impactful as your portfolio. Here is a calendar schedule for all the topics I cover at least once a year with my ongoing clients.

Creating an overall retirement plan

All of this is important, but what plays an even bigger part in determining your retirement success or failure is having an overall financial plan. Before you stop working, you should gain a picture of:

What the income is likely to be, after-tax

What your expenses will be

How you’ll get health insurance

What major contingencies could occur (health risks, home maintenance costs, caring for loved ones, etc.)

If you want our help in creating a retirement plan, please send me a note and let’s talk.

-Michael

Michael Hart, CFP® is an advice-only financial planner for mid-career professionals in Princeton, New Jersey.

P.S.

We are fee-only, flat fee advisors in Princeton, NJ who help mid-career professionals build wealth. If you’d like to meet with us to discuss retiring in New Jersey, how to create a financial plan for retirement, or any other topics related to your wealth, please set up a time.

Disclaimer

Investment advisory services are offered through Advice Only, Public Benefit Corporation, DBA Open Book Financial Planning, a Registered Investment Advisor in the State of CA and in other jurisdictions where registered or exempted (CRD# 334039). This communication is not intended as an offer or solicitation of any financial instrument or investment advisory services. Our current disclosure brochure, Form ADV Part 2, is available for your review upon request and at www.adviceonly.com