When 1% is not 1%

Michael Hart | August 8, 2025

A 1% advisor fee doesn’t sound like much… until you see the math.

But first –

As an advice only planner, we earn one fee for any and all advice we give you – independent of how much money you have.

We think it’s fairer that way.

Agree?

Because we are ultra-focused on helping you make smarter financial decisions – not just selling you products or trying to find the next hot stock tip – we entertain questions and write them up on our blog. And that’s what we’re doing this month with our blog about how much tax gets taken out of your “retirement check.”

And, we’ll try to answer it in two minutes or less.

Check out these blogs below that we’ve written about various financial planning topics for mid-career professionals.

Is a Roth Conversion really necessary?

How retirement benefits are taxed

Now for the feature presentation!

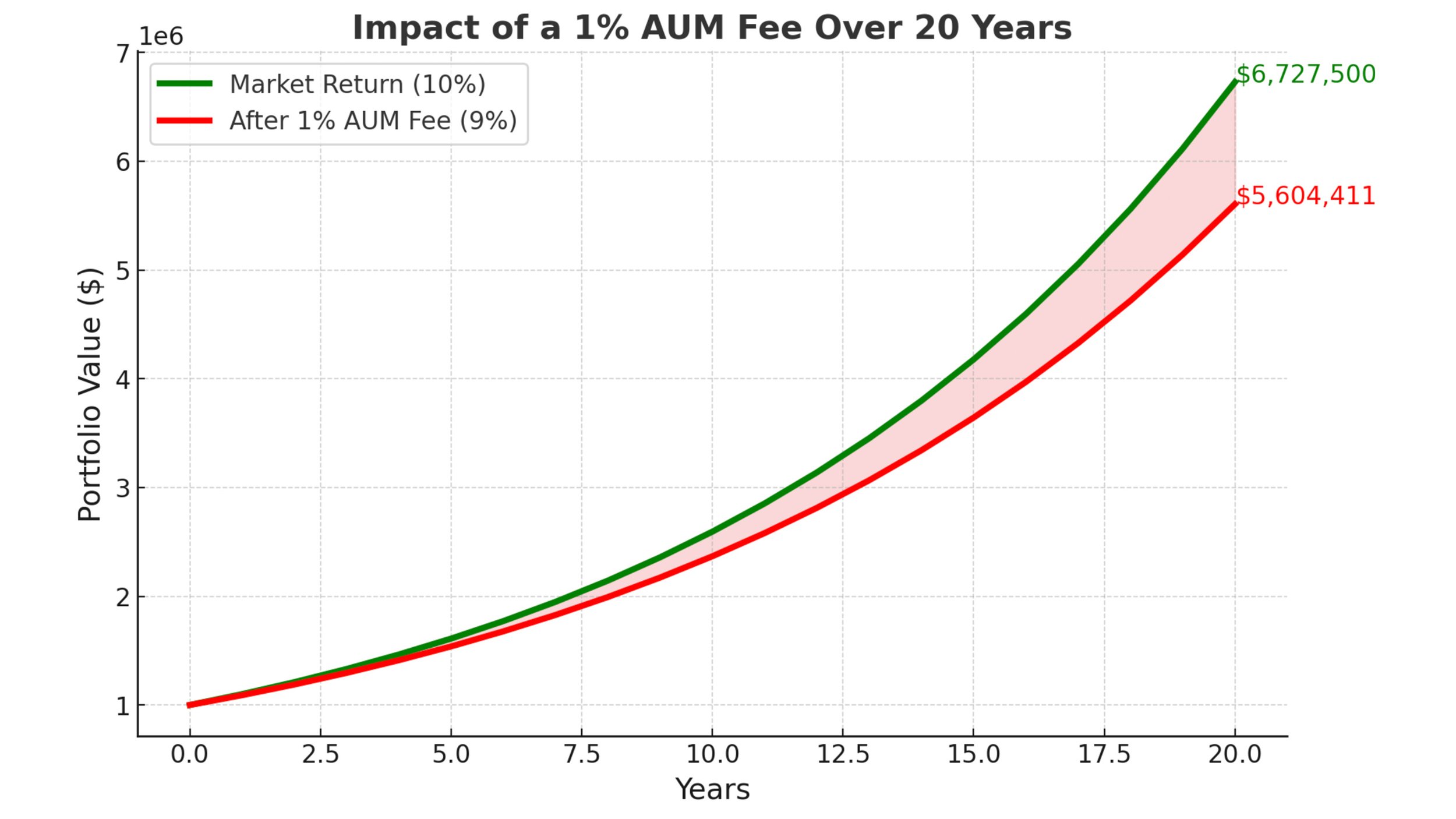

Market return: 10%

Advisor fee: 1% of assets under management

Your net return: 9%

That’s not a 1% cost… it’s 10% of your return for the year.

You’re giving up one out of every ten dollars your portfolio earns.

On a $1,000,000 account, that’s $10,000 gone in a single year.

If that $10,000 stayed invested at 10% per year, in 20 years it would be worth $67,000.

And that’s from just one year’s fee.

Pay that 1% every year and the lost growth can add up to hundreds of thousands—even millions over your lifetime.

Every advisor charges fees of some kind—but it’s critical that you absolutely understand what you are paying and how it impacts your returns over time.

Fees don’t just reduce your returns—they reduce the future your returns could have built.

Creating an overall retirement plan

All of this is important, but what plays an even bigger part in determining your retirement success or failure is having an overall financial plan. Before you stop working, you should gain a picture of:

What the income is likely to be, after-tax

What your expenses will be

How you’ll get health insurance

What major contingencies could occur (health risks, home maintenance costs, caring for loved ones, etc.)

If you want our help in creating a retirement plan, please send me a note and let’s talk.

-Michael

Michael Hart, CFP® is an advice-only financial planner for mid-career professionals in Princeton, New Jersey.

P.S. We are fee-only, flat fee advisors in Princeton, NJ who help mid-career professionals build wealth. If you’d like to meet with us to discuss retiring in New Jersey, how to create a financial plan for retirement, or any other topics related to your wealth, please set up a time.

Disclaimer

Investment advisory services are offered through Advice Only, Public Benefit Corporation, DBA Open Book Financial Planning, a Registered Investment Advisor in the State of CA and in other jurisdictions where registered or exempted (CRD# 334039). This communication is not intended as an offer or solicitation of any financial instrument or investment advisory services. Our current disclosure brochure, Form ADV Part 2, is available for your review upon request and at www.adviceonly.com